Blogs

The 2020-2021 Federal Budget - 12th October 2020

Last Tuesday the

Federal Government delivered the 2020-2021 Federal Budget and more importantly,

by Friday it has been passed by both Houses of Parliament.

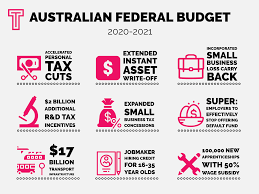

Billed as a road to recovery paved with cash, the key initiatives include:

- Personal income tax cuts

brought forward to apply from 1 July 2020,

- A $4 billion 'JobMaker' Hiring

Credit to encourage businesses to take on additional employees aged 16 to 35

years old,

- $110 billion in infrastructure

investment over 10 years,

- Immediate deductions for

certain business investment in capital assets,

- Changes to how companies can

manage losses, and

- Access to generous tax

concessions for a wider range of businesses.

In respect of the personal tax cuts, we have already had a

number of enquiries from clients as to what to about the higher rates of tax

already taken out to date. We remind all employers that they are obligated to

withhold taxes according to the schedules provided by the Australian Taxation

Office (ATO) and these rates usually find their way automatically into the

online payroll programs being used by most employers. That is the extent of

your obligations. We do not recommend trying to circumvent payroll calculations

that give employees a refund of the excess taxes taken out to date, you do not

have the authorisation from the ATO to do that.

An employee can always fill in a PAYG Withholding e-variation and send it to

the ATO. If the ATO approve the variation, then you as the employer will

receive a letter from the ATO outlining how much tax to deduct from now to 30

June 2021.

The link to the form is here - https://www.ato.gov.au/Forms/PAYG-withholding-e-variation/

The Budget also contains two additional Economic Support

payments to pensioners and other eligible recipients to drive money back into

the economy.

By comparison to many, Australia has managed the COVID-19

pandemic well, but good management isn't enough to protect us from the $213.7

billion deficit in 2020-21. The Government has taken to heart the old adage,

"You have to spend money to make money" to trade our way out of a

black hole.

Some of the measures are aimed at addressing the harsh lessons

COVID-19 has taught us and seek to centralise production back in Australia to

ensure our industries can be self-reliant.

Outside of the big ticket tax measures, what is striking about this

Budget is the sheer volume of initiatives it funds - too many to itemise in

this update. Many of the initiatives aim to improve how Government interacts

with the community and business in particular. This funding is focused on

streamlining interaction and compliance with Government requirements and

investing in the IT infrastructure required to digitise the compliance process.

The final

comments in the Treasurer's Budget speech paint a cautionary tale. The focus

right now is on the path to growth and stabilising debt in an effort to boost

consumer and business confidence. However, once “recovery has taken hold and

the unemployment rate is on a clear path back to pre-crisis levels†of below

6%, the second phase will kick in - the deliberate shift from providing

temporary and targeted support to stabilising debt.

Find full details of the 2020-20201 Federal Budget update here.